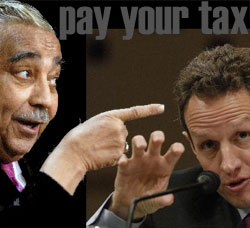

GEITHNER & RANGEL TO BE SUBPOENAED IN TAX FRAUD CASE

GEITHNER & RANGEL TO BE SUBPOENAED IN TAX FRAUD CASE

Federal Case Alleges Political Elite Get Favorable Tax Treatment Over Ordinary Citizens

Why is it that political insiders get a pass on their tax problems when ordinary citizens get criminally prosecuted?

– Tim Geithner, political insider: Back taxes owed, no prosecution

– Charles Rangel, political insider: Back taxes owed, no prosecution

– Tom Daschle, political insider: Back taxes owed, no prosecution

– David Jacquot, ordinary citizen and retired Army Officer: NO taxes owed, PROSECUTION?!?

On 5 March 2009 a Motion was filed in U.S. v. David Jacquot, Case # CR 08-1171, in the Federal District Court, in San Diego, California seeking to dismiss a false tax return indictment on the grounds that the Defendant was not treated in the same manner as politically prominent individuals. A hearing on this matter is set for 30 March 2009 in San Diego and the Defendant in this case intends to subpoena Secretary of the Treasury Timothy Geithner, House Ways and Means Chairman Charles Rangel, former Senate Majority Leader Tom Daschle, and others.

The Defendant in this case is David Jacquot, an attorney and retired Army Officer. He is a decorated disabled Desert Storm veteran living in rural Idaho with his family.

This “Geithner Motion” cites HR 735 titled the “Rangel Rule Act of 2009,” which if enacted, would eliminate penalties and interest for common citizens to allow them to be treated in the same manner as House Ways and Means Chairman Representative Charles Rangel. The Geithner Motion also quotes President Obama stressing the need to “treat common citizens in the same manner as politically prominent individuals in regards to tax matters”.

The Geithner Motion details how Mr. Jacquot was vindictively indicted in retaliation for his successful defense of his clients against the IRS. The tax returns of his corporate law firm for the four (4) years of 2001 to 2004 were investigated and the government alleges that the law firm declared almost $200,000 TOO MUCH income during this time period. The Geithner Motion contains descriptions of numerous actions by the government and Assistant U.S. Attorney (AUSA) Faith Devine that are the basis for the claim of retaliation against Mr. Jacquot for his zealous representation of his client’s Constitutional and statutory rights. The improper actions of AUSA Devine have been reported to the DOJ Office of Professional Responsibility for disciplinary action and are currently under review.

A copy of the Geithner Motion and the complaint against AUSA Faith Devine can be downloaded at: www.jacquotlaw.com/vindictive-prosecution.html

David Jacquot can be reached via email at dave@jacquotlaw.com

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy