From Naked Capitalism:

William White, the former chief economist at the Bank of International Settlements (BIS) gave an important speech at George Soros’ Inaugural Institute of New Economic Thinking (INET) conference in Cambridge.

While everyone is casting about for the one magic bullet solution which would have prevented this and future crises, he placed the blame for the credit crisis on short-termism, pointing the finger most notably at economists and their models. White said that the models almost all economists use are ‘flow’ models which leave no room for ’stocks’ and thus completely miss unsustainable secular trends.

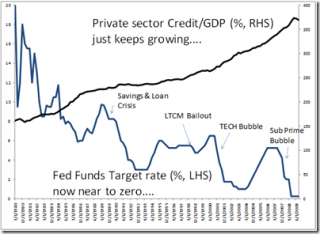

In essence, White was saying: “it’s the debt, stupid.” When aggregate debt levels build up across business cycles, economists focused on managing within business cycles miss the key ingredient that leads to systemic crisis. It should be expected that politicians or private sector participants worried about the day-to-day exhibit short-termism. But White says it is particularly troubling that economists and their models exhibit the same tendency because it means there is no long-term oriented systemic counterweight guiding the economy.

This short-termism that White refers to is what I call the asset-based economic model. And, quite frankly, it works – especially when interest rates are declining as they have over the past quarter century. The problem, however, is that you reach a critical state when the accumulation of debt and the misallocation of resources is so large that the same old policies just don’t work anymore. And that’s when the next crisis occurs.

Let me take you through my thinking on this step by step. This is a pretty long post because I want to cover a lot of topics. But they should fit together from the economic models to the likely outcome.

The topics are:

- The concentration of economic models on flow and the failure to model debt stocks

- The empirical evidence that debt stocks have been increasing across a broad swathe of private sector dimensions

- The doom loop of ever lower interest rates that allows debt stocks to increase

- The effect that a secular decrease in interest rates has on an economy’s ability to increase debt loads

- The evidence that monetary stimulus is no longer effective in allowing debt levels to increase

- The likely outcome of a balance sheet recession and a secular decrease in debt

The concentration of economic models on flow

First, from a post called “Why economists failed to anticipate the financial crisis,” I echoed White’s sentiments when reviewing a widely read piece by Paul Krugman on why economist’s failed to anticipate the crisis:

Paul Krugman is a Keynesian. So, his prescription is fiscal stimulus. Have the government pump money into the economy and it will alleviate some of the pressure for the private sector. There is some merit to this argument on stimulus. Many Freshwater economists say monetary stimulus is what is needed. If the Federal Reserve increases the supply of money, eventually the economy will respond. This is what Ben Bernanke was saying in his famous 2002 Helicopter speech at the National Economists Club.

Yet, I couldn’t help but notice that Krugman mentioned the word debt only twice in 6,000 words. In fact, it is in the very passage above where Krugman uses the term for the only time in the entire article. And here Krugman refers to government debt; no mention of private sector debt whatsoever. I have a problem with that….

This economic Ponzi scheme is what I have labeled the asset-based economy. As with all things Ponzi, it must come to a spectacularly bad end. One can only Inflate asset prices to perpetuate a debt-fuelled consumption binge so far. At some point, the Ponzi scheme collapses. And we are nearing that point. We still have zero rates, massive amounts of liquidity, manipulation of short-term rates, manipulation of long-term rates, and bailouts galore a full 15 months after Lehman Brothers collapsed. This is pure insanity.

The reason economists failed to anticipate the crisis is because they were fixated on avoiding downturns and driving the economy to unsustainable growth rates by using debt to consume today what will be earned in the future. Debt is the central problem. When debt to income or debt to GDP doubles, triples and quadruples, it says you have doubled, tripled and quadrupled the amount of future earnings you are consuming in the present (see the charts here and here). That necessarily means you will have less to spend in the future. It’s not rocket science. … — From Naked Capitalism. —

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy