By Paul Krugman

Misplaced Optimism

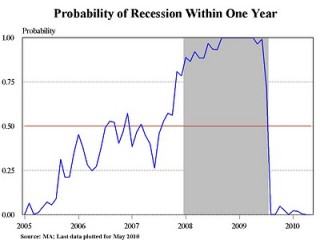

I wish I could believe in this Macroeconomic Advisers claim that there is a zero chance of a double-dip recession. But when they say that this probability is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production

I immediately lose all confidence.

When short-term interest rates are up against the zero lower bound, a positive term spread tells you nothing; as I explained a year and half ago, it’s something that has to happen given the fact that short rates can go up, but not down.

Failure to understand this point led to excess optimism in late 2008. I’m a bit surprised to see Macroeconomic Advisers falling into the same fallacy now.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy