If you thought Wall Street’s debt crisis was traumatic, wait till you the see the consequences of Washington’s debt crisis!

Words: 1128

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com, provides below further reformatted and edited [..] excerpts from <strong>Martin D. Weiss’ (www.moneyandmarkets.com) original article* for the sake of clarity and brevity to ensure a fast and easy read. He goes on to say:

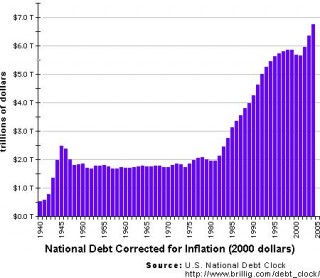

Never before in history has a world power like the U.S. been so utterly buried in debt and never before has that debt been financed so massively by foreign investors! The consequences will be dire if history is any guide:

a) 19th century Mexico, Spain, and Argentina accumulated so much debt, they were forced to default.

b) In the 20th century, a similar fate befell Germany (1932) … China (1939) … Turkey (1978) … Mexico again in 1982 … Brazil and the Philippines (1983) … South Africa in 1985 … plus Russia and Pakistan in 1998.

c) Argentina kicked off the 21st century with a default in 2001.

d) Barring a euro zone rescue, Greece, Spain, and Portugal are prime candidates for debt defaults this year.

In none of the examples above did the debts represent[ed] little more than a small fraction of the total debts outstanding worldwide but that is not so in our case today! The United States government and its agencies have the largest pile-up of interest-bearing debts ($15.6 trillion), the largest accumulation of unsecured obligations (over $60 trillion), the largest yearly deficit ($1.6 trillion), and the greatest indebtedness to the rest of the world ($4.8 trillion).

In proportion to the size of its economy, one important country, Japan, does have more debt than the U.S. but unlike Washington’s debts, nearly all of Japan’s debts are financed by its own citizens — loyal, long-term savers who are far less likely to pull out in a storm.

Washington’s debt crisis represents a unique, unparalleled, and unimaginable convergence of circumstances because no one can answer this simple question being asked by former GAO chief David Walker: Who will bail out America? Not you, not me, and not 300 million Americans! Not China, not Japan, nor all the powers on Earth put together! They’re simply not big enough. They don’t have the money.

Despite the utter gravity of our plight, however, nothing is being done to change our course. Congress can not even agree to study the issue. Congress could not vote on a deficit commission so the President appointed a separate commission but it will have no authority to bring its recommendations to a vote in Congress — let alone get them passed. The consequences of this complacency will be catastrophic. To whit:

Consequence #1: Interest Rates will Rise

Due to the avalanche of government borrowing to finance the deficit, there is no power on Earth that can avert sharply higher interest rates. Just a few weeks ago, the yield on 30-year Treasury bonds busted through a declining trend that had not been penetrated in more than 20 years and just last week, it came within a hair of its highest level in over two years. With just one more, ever-so-slight nudge to the upside, all heck could break loose in the Treasury-bond market. You could see a surge in long-term interest rates that will make your hair curl.

What’s so damning about this action in the bond market right now is the fact that it’s coming at the worst possible time and that is why Washington and Wall Street fear it so much. That’s why they’re so anxious NOT to tell you about it.

Consequence #2: Bond Yields will Soar

All long-term bonds — whether issued by other government agencies, corporations, states, or municipalities — will also collapse, driving their yields through the roof because, when Uncle Sam has to pay more to borrow, they inevitably have to pay more as well.

Consequence #3: Rates on Mortgages and Car Loans will Surge

Why? For the simple reason that they’re also tied at the hip of long-term Treasury rates.

If you want to take out a 30-year fixed mortgage (now close to 5 percent) on a median-priced home ($178,300), and you can afford a 10 percent down payment just a 1 percent rise in rates will drive your monthly payment from $861 to $962 and a 2 percent increase will drive it to $1,068 per month. That’s $1200 to $2500 more per year! Worse, if you go for variable-rate mortgages, balloon mortgages, or other now hard-to-get alternatives, the impact of surging interest rates will be even more traumatic.

Consequence #4: Fledgling Recovery will Stall

The fledging recovery in housing and auto sales — the pride and joy of Washington’s bailout brigades — will be toast.

Consequence #5: Long-term Bonds will Plummet

Institutions and individual investors holding piles of lower yielding long-term bonds will get killed. Not all of these holdings are of the long-term variety but most are and investors and institutions who own them on behalf of millions of retirees will suffer shocking declines in the market value of their portfolios gutting their income stream as a result.

Worst of all, we now have some reason to fear the de facto default of the biggest debtor of all — the government of the United States of America – although I doubt very much we will see THAT happen.

Nevertheless, it is quite possible, even likely, that America will lose its triple-A rating and if the Wall Street rating agencies don’t have the moral fiber to announce downgrades, the marketplace will do it for them.

Ultimately, there is NO choice. We must bite the bullet. We must make the sacrifices. Like California and Greece … like every household and any company … our government MUST cut back and accept the rest of the consequences:

Consequence #6: Declining Home Values

Consequence #7: Falling Stocks

Consequence #8: The End of the Recovery

… and many, many more.

Our leaders will eventually face an Armageddon unlike any since the Civil War unless they must either muster the courage — and the support of the people — to accept the pain and make the sacrifices of a lifetime … or face the downfall of America. They will, no doubt, seek every other alternative and try every other trick but, alas, no printing press can run faster than our foreign creditors can sell their U.S. bonds. No one will bail out America.

*http://www.moneyandmarkets.com/armageddon-3-37911 (Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil.)

Editor’s Note:

– The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

– Permission to reprint in whole or in part is gladly granted, provided full credit is given.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy