When people find themselves in a situation where they feel they don’t have a decent grip on the risks they face, or where a great deal of critical information is hidden from view, emotions can easily overwhelm rational decision-making. Is it so far-fetched to think that a sudden loss of confidence in the United States’ ability to manage its finances could evoke similar fears about just how large and widespread the fallout might be? Words: 1011

When people find themselves in a situation where they feel they don’t have a decent grip on the risks they face, or where a great deal of critical information is hidden from view, emotions can easily overwhelm rational decision-making. Is it so far-fetched to think that a sudden loss of confidence in the United States’ ability to manage its finances could evoke similar fears about just how large and widespread the fallout might be? Words: 1011

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com, provides below further reformatted and edited excerpts of an interview* by Jeanne Sahadi (www.money.cnn.com) with Michael Panzer (www.financialarmageddon.com) for the sake of clarity and brevity to ensure a fast and easy read. Panzer had the following to say:

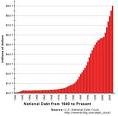

Debt That’s Accounted For

When anyone talks about U.S. debt, they typically refer to a) the debt held by the public (i.e. money owed to those who have bought U.S. Treasuries, most notably big bond mutual funds and foreign governments) and b) the money the federal government owes to government trust funds, such as those for Medicare and Social Security. in addition to that public debt are the trillions in unforeseen and underplayed obligations that could make the debt outlook much much worse.

Here is just a sampling of the debt obligations not on the books that the deficit hawks are so worried about:

Debt That’s Not on the Books

1. Losses from Fannie Mae and Freddie Mac are Unmeasured, Unrecognized in the Budget and Unmanaged

Mortgage giants Fannie Mae and Freddie Mac are private companies that for years had the implicit backing of the federal government. That backing assured investors that if anything went seriously south for the companies Uncle Sam likely — although not absolutely — would step in. Well, things did go south, and now both are run by the federal government.

While the implicit guarantee has become explicit for Fannie and Freddie, its treatment in the budget is up in the air. “Our budget doesn’t have Fannie Mae and Freddie Mac on it, even though it’s owned lock, stock and barrel by the American taxpayer,” said Rudolph Penner, a former director of the Congressional Budget Office (CBO) during a conference held by the Peterson-Pew Commission on Budget Reform.

Last year, the CBO did start to account for both companies as if they were federal agencies on the budget but the White House Budget Office only includes some potential costs because the future of the two companies is still under consideration.

It’s estimated that the total loss on the mortgages backed by the companies could reach $448 billion, with a portion of that covered by reserves or assumed by outside parties. The CBO estimated the net costs to the government could top $370 billion by 2020. These are just estimates but what’s clear is that Fannie and Freddie are not cheap dependents and that’s why some argue that lawmakers should assess the potential costs of implicit government guarantees well before things go to pot.

“Their costs are largely unmeasured, unrecognized in the budget and unmanaged,” federal budget expert Marvin Phaup wrote in a recent paper. “A troubling aspect of current policy aimed at restarting the financial markets is the likely expansion of implied guarantees to include the obligations of additional private financial institutions.”

2. Social Security and Medicare Expenses are Unfunded

The governments’ accrued debt to the Social Security and Medicare trust funds is known but making those payments — which which will happen by 2037 for Social Security and within the next decade for Medicare –won’t be easy given the drop in federal revenue and the surge in government spending.

At that point, the programs will only be collecting enough in taxes to pay a portion of the benefits currently promised. There will be enormous pressure on the government to make up the difference, and Uncle Sam would have to borrow a lot of money to do so. Right now, money allocated to both entitlement programs is considered “mandatory” spending and therefore the spending increases for the programs are on autopilot and the financial commitment is uncapped in future years.

Some budget experts like Stuart Butler, vice president for domestic and economic policy at the conservative Heritage Foundation, would like to see the long-term obligations to Medicare and Social Security included in lawmakers’ annual consideration of the federal budget.

3. The True Cost of Tax Breaks

Everybody loves tax breaks and there’s more than a trillion dollars of them to love. That’s the amount of money the Treasury forgoes in annual revenue as a result of the many breaks in the tax code which effectively increases the government’s need to borrow.

This trillion-plus in tax breaks isn’t really up for consideration during annual budget discussions yet, while no one advocates abolishing tax breaks altogether many believe that tax breaks should be treated as discretionary spending. The idea is to bring them into the open so lawmakers can make a conscious decision annually about what they spend on tax breaks and recognize the costs associated with that decision.

4. Long-term Costs of New Roth IRA Rules

This year is the first year in which high-income investors with traditional IRAs or 401(k)s — both of which let savings grow tax-deferred until withdrawn — will have a chance to convert their accounts into Roth IRAs, where investments grow tax-free.

The new conversion rule is scored as a revenue raiser on the federal budget over the next decade because those who convert must pay the tax owed on their traditional IRA savings the year they convert but long-term it’s a different story. Since investments in the converted accounts will grow tax-free, Uncle Sam will collect considerably less revenue than he otherwise might have had the investors kept their ever-larger savings in a traditional IRA and paid taxes on them in retirement.

*http://www.financialarmageddon.com/2010/03/is-it-so-farfetched.html?

*http://money.cnn.com/2010/03/01/news/economy/budget_debt/index.htm

Editor’s Note:

– The above article consists of reformatted edited excerpts from the original for the sake of brevity, clarity and to ensure a fast and easy read. The author’s views and conclusions are unaltered.

– Permission to reprint in whole or in part is gladly granted, provided full credit is given

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy