by Yukon Jack

The credit boom came to an end in the 2006-2008 financial crisis, and slowly but surely deflationary forces are starting to exert a dominant influence on all markets. The Federal Reserve, a quasi-private-public entity has played the central role in the boom and bust and is unable to stop a depression even though its original charter was sold on that idea.

Since the end of the international gold exchange standard in 1971, there has been an unprecedented expansion of credit. Without any gold backing, credit growth based on fiat currency was unlimited, the last four decades have resulted in a 50 trillion dollar expansion of credit, and its undoing threatens the solvency of the United States and the Federal Reserve. The survival of the United States as a nation is now in question, already totalitarian forces are sharpening their knives for the destruction of the union.

There are two main drivers to the American economy, home construction and auto manufacture, both are in decline who’s descent has been lessened by falling interest rates to historic lows. Rates went lower than the Great Depression even though debt is at historic high levels by all measures, and now a sudden reversal and rising rates will kill home and auto sales sending America into an economic death spiral and another ‘Great Depression’, possibly the greatest depression of all time that ends Western Civilization.

The Housing Market

In a debt-ridden society, credit is ‘money’, the long prosperity of the last 4 decades was created by an expansion of credit, high home and car prices is due to easy credit, thus a contraction in credit will be deflationary. This happened in 2008 with housing, the easy home loans fueled the final boom and now its gone bust, without easy credit the housing market coast to coast has declined dramatically. A $250,000 house, that traded for $50,000 a couple of decades earlier, can only exist so long as easy credit terms exist – low rates and low monthly payments.

Most consumers do not have $250,000 in cash laying around, and those that do are probably smart enough to know not to purchase an inflated property price. House prices are still in the stratosphere, but the majority of people believe that sky-high home prices are normal and are counting on them staying that way for sale or retirement. This is pure wishful thinking, home prices are overly inflated by a severely over-inflated credit market. So far home prices have declined in most major cities, but we haven’t seen the depression lows because interest rates are now going up, the final leg down will now commence with the reversal in bond prices.

Home prices are far above the 100-year inflation-adjusted mean, decades of successful and repeated credit infusions by the Federal Reserve Corporation have convinced the public that inflation and high home prices are normal. But they are not, they are completely artificial and against natural law, who can afford current home prices without credit? The bust will send prices lower, it would be normal for the market to overshoot to the downside once the credit contraction gets going. All credit busts go lower than where they started, it is perfectly reasonable to expect the correction will overshoot and go below the mean, below 100 on the chart:

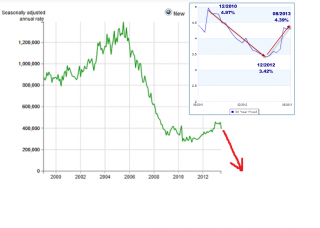

Historic low mortgage rates of 3.42% last year stimulated a slight increase in new home sales. The Fed’s limp impotence to stimulate a dying home market are evident. Rates have now edged up in the last 12 months, and new housing sales have instantly reversed, a mere 100 basis point increase in 30-year mortgage rates has already caused the death knell of housing, what will happen in the upcoming credit market panic when rates soar?

New home sales have been plummeting, the FED lowered rates to lower than the Great Depression, and that only resulted in a slight gain, rising rates will absolutely kill new home sales and send them toward zero. Imagine that, new home construction is about to come to a standstill.

There are millions and millions of homes in foreclosure and millions and millions more unsold, the only way for this market to proceed is steep discounts. Even now houses for a dollar are spreading, Gary, Indiana has now joined Detroit in offering homes for $1.

Yes, you can buy a house for a buck! And you can buy whole blocks of houses and become a slum lord. Once people see houses selling for cheap, that changes their minds about what a house is worth. High home ‘values’ is a myth lodged in the brains of brain-dead consumers, a house is a commodity like any other commodity and its price is set by market forces, oversupply will eventually overwhelm this last vain attempt of the banking system to keep prices high and their balance sheets in the black.

$1 homes in:

Gary, Indiana

Detroit, Michigan

Investors buying Detroit properties

Milwaukee, Wisconsin

Orange County, California – Buy a house for a $1 and move in –

Over 50% of home sales are now for cash. This is a significant change, people are averse to borrowing money or using credit, and the new trend is credit aversion. This is significant for bank lending, in the perverse world of bank lending, the mortgage becomes a deposit for more loans, since people are avoiding banks the banks will not be able to keep the bubble inflated. The engine of fractional reserve banking has come to an end.

Is 2013 the new 1931 and will 2014 be the new 1932? Is Keynesian Economics teetering on collapse? I know depression when I see one and I see bargains, and I also see that most home prices are vastly inflated by decades of speculation and inflation hedging. How can students, saddled with college debt and facing a pitiful job market afford homes? They can not unless prices go way, way down.

Fortunes will be made in this depression, those buying distressed properties could end up owning the monopoly board. During the Great Depression, many homes declined by over 90%, some 99%. This hasn’t happened yet but it is going to happen now as interest rates spike. This time interest rates are going up from fear in the credit markets, baby the ‘panic is on’!

The Automotive Market is Becoming the Bicycle Market

Extremely low rates of financing have fueled a bounce in sales, but not much longer, just like home sales, cars require financing.

There are 254,000,000 registered vehicles in America. The number of miles driven is falling off the cliff as gasoline prices remain high. There is a dramatic change going on. What is causing this new trend?

Gasoline sales are falling off the cliff. Not a mention of this in the mainstream media. Are there any journalists left?

The number of registered cars in Portland, Oregon is falling even though the population has been rapidly increasing. Same for Boston:

People are trading bicycles for cars or second cars. There are big advantages of a bicycle in a government parasitic economy – low upfront cost, no insurance, no fuel costs, no yearly registration tax, no parking or red light camera tickets or parking meter costs, and no traffic jams and even a reduction in stops as bikeways are stopped light free. Bicycle commuting becomes a big thing in Portland, Oregon:

http://bikeportland.org/wp-content/uploads/2012/05/bike_network_animation_530w.gif

As gasoline prices went higher and higher, bike production outgrew autos:

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy