By F. William Engdahl, with New Eastern Outlook, Moscow

– First published May 12, 2014 –

To read the headlines, it seems that the USA has emerged out of the blue to the point of becoming the world’s oil and gas production giant. All thanks to the Shale Revolution.

Recently President Obama made various noises that the US could solve the Ukraine gas dependency on Russian gas because of the spectacular growth of extracting natural gas, and more recently, oil, from shale rock formations across the US. There’s only one thing wrong with this picture—“It ain’t gonna happen…”

The surface numbers are indeed impressive to a layman or politician. According to US Government Energy Information Administration data, between 2005 and 2010 the contribution from shale gas to total US-marketed gas production rose from less than 2% to more than 20%. And 2011 set an all-time record for US production as the result of shale gas growth.

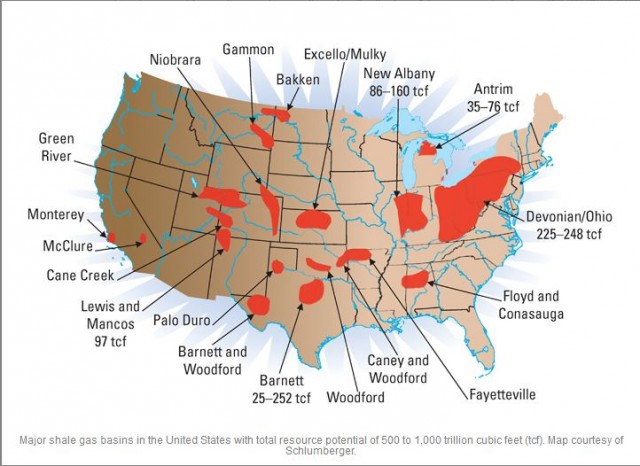

However, shale gas comes from a small number of areas with significant and viable shale rock formations that have trapped gas and oil in the interstices of the sedimentary shale rocks. The main shale gas areas are the Barnett Shale in Texas

Fort Worth basin; the Fayetteville and Woodford shales of the Arkoma basin in Arkansas and Oklahoma; the Haynesville shale on the Texas-Louisiana border; the Marcellus shale in the Appalachian basin, and the most recently exploited, the Eagle Ford shale in southwest Texas.

Two metrics widely used in describing shale well performance are the initial production (IP) rate and the production decline rate which together determine the ultimate recovery (UR) from a well, an essential number in determining economic viability. A group at MIT University in Massachusetts carried out an analysis of production data from the major US shale regions. What they found is sobering.

While initial production from most shale gas plays was unusually high, an essential component of the Wall Street shale gas bubble hype, the same gas regions declined dramatically within a year. They found “in general, shale well output tends to drop by 60% or more from the Initial Production rate level over the first 12 months.

The second metric is that the available longer-term production data suggest that levels of production decline in later years are moderate, often less than 20% per year.”

Translated, that means on average after only four years, you have only 20% of your initial gas volume available from a given horizontal drilling investment with fracking. After seven years, only 10%. The real volume shale gas boom appeared in 2009. That means in the fields where significant drilling was present by 2009 are already dramatically depleted by 80% and so on by 90%.

The only way oil or gas drillers have managed to maintain production volume has been to drill ever more wells, spend ever more money, taking on ever more debt in hopes of a sharp rise in the depressed US domestic gas price. As a whole shale energy companies spend more than they are making in net profit, creating a bubble of “junk” bond debt to keep the Ponzi game going. That bubble will pop the second the Fed hints interest rates will rise, or even sooner.

The industry tries hard to pump the prospects of the shale revolution. One of the most outspoken recently was the CEO of Conoco/Philips, Ryan Lance.

Taking a baseball analogy, he recently told an energy conference in Houston that the shale gas “revolution” in the country is only just beginning and there should be several decades left of successful energy production: “We’re in the first inning of a nine-inning game on the shale revolution in the United States.” He did not make clear what the scientific connection between baseball and shale gas was.

The reality of the shale gas boom is increasingly being shown to be quite different. According to Arthur Berman, a petroleum geologist with 34 years of experience who has studied production and other aspects of the shale gas and oil boom, “forecasts show production in shale plays from North Dakota’s Bakken to Texas’s Eagle Ford will peak around 2020. Those investing with the expectation that the boom will last for decades are “way out of line.”

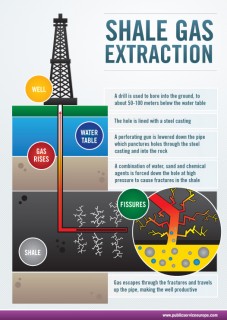

To be concrete, the major shale formations in the US, and there are not that many geologically speaking, will begin an absolute production decline in less than six or seven years. Unlike conventional gas or oil fields, shale is an unconventional and difficult way to extract energy by the highly controversial and toxic practice of “fracking” or hydraulic fracturing of the shale formations. As the shale runs horizontally, the perfection of new horizontal drilling techniques in the 1990s opened commercial prospects for shale gas for the first time.

Fracking the Bakken Formation in North Dakota

The hydraulic fracture is formed by pumping a fracturing fluid—typically highly toxic and exempt, thanks to then-Vice President Cheney’s Congressional influence, from EPA Clean Water Act regulations—into to the wellbore at a rate sufficient to increase pressure down-hole at the target zone.

The rock cracks and the fracture fluid continues further into the rock, extending the crack still further, and so on. Often up to 70% of the toxic fracking fluids leak and in many cases in Pennsylvania and elsewhere seep into the groundwater.

Even the US Government’s EIA projects that US oil output will peak at 9.61 million barrels a day in 2019. They see tight oil or shale oil topping at 4.8 million barrels in 2021.

That’s only seven years out. And if the US Government is trying to fast-track approval of LNG gas export terminals on coastal ports to allow US gas companies to export their gas, completion of such complex terminals including environmental impact approvals typically takes seven years. Hmmmm.

Wall Street easy money

No one expects the President of the US to have the time or the scientific background to delve into the geophysical complexities of shale energy. He naturally relies on competent advisers. What if the advisers, instead of being competent, like in so many government agencies today, are in the sway (and sometimes perhaps pay) of the shale energy companies and their Wall Street investment bankers who have hundreds of billions of dollars riding on promoting the shale hype?

The current US Shale boom is being sustained on steroids, otherwise known as the Fed’s never-ending Quantitative Easing zero-interest-rate policy, a stance that shows no sign of reverting to normal interest rate levels as the economy continues to be depressed since the collapse of the 2007 real estate mortgage securitization bubble.

In effect, shale drillers are able to keep in business only because Wall Street and other investors continue to throw money at them like it was falling from trees. Tim Gramatovich, chief investment manager for Peritus Asset Management LLC, an $800 million fund, notes, “There’s a lot of Kool-Aid that’s being drunk now by investors. People lose their discipline. They stop doing the math. They stop doing the accounting. They’re just dreaming the dream, and that’s what’s happening with the shale boom.”

Given the endless zero interest rate regime of the Fed, investment funds are desperate to find investments that yield higher interest. They are so desperate they are pouring money into shale gas and shale or tight oil companies like never before. The companies are operating at losses, loaded with debt and the credit rating agencies rate their debt as “junk”, i.e. in a market downturn, likely to default.

One such company, Rice Energy, sold its bonds in April with a rating of CCC+ by Standard & Poor’s, seven steps below investment grade. That is below the minimum risk/quality level that major investors, such as pension funds and insurance companies, are allowed to buy. S&P says debt rated in the CCC range is “currently vulnerable to nonpayment.” Despite that, Rice Energy was able to borrow at an astonishingly low 6.25 percent.

“This is a melting ice cube business,” said Mike Kelly, at Global Hunter Securities in Houston. “If you’re not growing production, you’re dying.” Of the 97 energy exploration and production companies rated by S&P, 75 are “junk” or below investment grade. The shale “revolution” is but a Ponzi Scheme disguised as an energy revolution.

F. William Engdahl is a strategic risk consultant and lecturer, holding a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook.”

Editing: Jim W. Dean and Erica P. Wissinger

Frederick William Engdahl (born August 9, 1944) is an American writer, economics researcher, historian, and freelance journalist.

He is the author of the best-selling book on oil and geopolitics, A Century of War: Anglo-American Oil Politics and the New World Order. It has been published as well in French, German, Chinese, Russian, Czech, Korean, Turkish, Croatian, Slovenian, and Arabic. In 2010 he published Gods of Money: Wall Street and the Death of the American Century, completing his trilogy on the power of oil, food, and money control.

Mr. Engdahl is one of the more widely discussed analysts of current political and economic developments, and his provocative articles and analyses have appeared in numerous newspapers and magazines and well-known international websites. In addition to discussing oil geopolitics and energy issues, he has written on issues of agriculture, GATT, WTO, IMF, energy, politics, and economics for more than 30 years, beginning the first oil shock and world grain crisis in the early 1970s. His book, ‘Seeds of Destruction: The Hidden Agenda of Genetic Manipulation has been translated into eight languages. A new book, Full Spectrum Dominance: Totalitarian Democracy in the New World Order describes the American military power projection in terms of geopolitical strategy. He won a ‘Project Censored Award’ for Top Censored Stories for 2007-08.

Mr. Engdahl has lectured in economics at the Rhein-Main University in Germany and is a Visiting Professor in Economics at Beijing University of Chemical Technology.

After a degree in politics from Princeton University (USA), and graduate study in comparative economics at the University of Stockholm, he worked as an independent economist and research journalist in New York and later in Europe, covering subjects including the politics of energy policy in the USA and worldwide; GATT Uruguay Round trade talks, EU food policies, the grain trade monopoly, IMF policy, Third World debt issues, hedge funds, and the Asia crisis.

Engdahl contributes regularly to a number of international publications on economics and political affairs including Asia Times, FinancialSense.com, 321.gold.com, The Real News, Russia Today TV, Asia Inc., GlobalResearch.com, Japan’s Nihon Keizai Shimbun, Foresight magazine. He has been a frequent contributor to the New York Grant’sInvestor.com, European Banker and Business Banker International and Freitag and ZeitFragen in Germany, Globus in Croatia. He has been interviewed on various geopolitical topics on numerous international TV and radio programs including Al Jazeera, CCTV and Sina.com (China), CCTV (China) Korea Broadcasting System (KBS), and RT Russian TV. He is a Research Associate of Michel Chossudovsky’s well-respected Centre for Research on Globalization in Montreal, Canada, and a member of the editorial board of Eurasia magazine.

Mr. Engdahl has been a featured speaker at numerous international conferences on geopolitical, GMO, economic, and energy subjects. Among them is the Ministry of Science and Technology Conference on Alternative Energy, Beijing; London Centre for Energy Policy Studies of Hon. Sheikh Zaki Yamani; Turkish-Eurasian Business Council of Istanbul, Global Investors’ Forum (GIF) Montreaux Switzerland; Bank Negara Indonesia; the Russian Institute of Strategic Studies; the Chinese Ministry of Science and Technology (MOST), Croatian Chamber of Commerce and Economics.

He currently lives in Germany and, in addition to teaching and writing regularly on issues of international political economy and geopolitics, food security, economics, energy, and international affairs, is active as a consulting political risk economist for major European banks and private investors. A sample of his writings is available at Oil Geopolitics.net

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy