Editor’s note: A surprising piece here from Mr. Engdahl on an issue that I had missed completely, that China had made a big shale gas development push, stimulated by what the US had been doing.

William has already written about the shale gas hype story here, how the new wells’ output dropped quickly and gross production had only been maintained upward for the “boom period” by vastly increasing the number of wells drilled.

Despite his exposé, the American energy hustlers, all the way up to Congress, pitched our replacing a lot of Russian gas in Europe with the huge fairy-tale shale gas production that was going to give us a big export capacity.

And of course, they left out the higher cost on the LNG handling and a $100 billion of investment on the European side for landing and infrastructure work.

But hustlers never let negative items like that wreck a good hype deal. That was our job at VT, and we shot it down in flames the first week. After the first promotional pitch, shale gas for Europe disappeared from the discussion. That said, the US got the EU to be its blowup doll for the Russian counter-sanctions. Those with big export business to Russia took quite a licking… pardon the expression.

I suspect that because the shale gas fields were in the far West of China, they may have been hoping enough could be produced for local needs and save on the transportation infrastructure needed to get energy out there to a growing economy, as Peking has been wanting to spread the population out more.

But all is well with the big Russian gas deal… for the long-term contract and the security of delivery by easy-to-guard pipelines, versus the ocean delivery that the US Navy can shut off whenever it wanted. Even the Iranians are hoping to be able to pipe gas to Europe themselves, not to knock Russia out of the box, but to eventually get enough EU gas business to cover its trade import needs long term… Jim W. Dean

First published September 9, 2014

China Shale Gas Strategy a Fiasco

by F. William Engdahl, with New Eastern Outlook, Moscow

Two years ago the government of the Peoples Republic of China staked a major hope for its energy future on the exploitation of domestic natural gas from its large shale rock formations, so-called shale gas.

Today, after hundreds of millions of dollars in investment and significant drilling, the dream has evaporated like the ephemeral shale gas they counted on.

Wu Xinxiong, head of the National Energy Administration of China, announced in a speech the surprising news that China’s official target for domestic natural gas production in 2020 was now 30 billion cubic meters for shale gas and another 30 billion cubic meters for coal seam gas.

Just two years ago, the Chinese National Energy Administration estimated that China would produce 60 billion to 100 billion cubic meters only of shale gas by 2020. If Wu’s forecast comes true, shale gas and coal field gas would each supply only 1 percent of China’s electricity generation needs in 2020. Realistic prospects are it will not even reach that level.

The admission by the government has major geopolitical implications. First, it is a major reason why Beijing, after years of indecision, this May signed the 30-year $400 billion “Gas deal of the Century” with Russia for Gazprom gas to be delivered to China. That deal moved China and Russia a giant step closer in terms of strategic cooperation.

The reason Beijing finally agreed after years of dickering over price was the realization that the US Government and oil company hype about China holding the world’s largest reserves of shale gas was just that—politically-motivated hype.

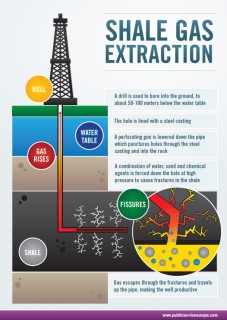

Even if shale gas were a possible solution to the huge future energy needs of the world’s second-largest economy, which it isn’t, the geology of shale rock formations in China is vastly different and less suitable than in the USA. Shale gas deposits lie much deeper in China than in the US. That greatly adds to drilling costs.

The cost for each new well in China is roughly three times the cost in the United States. Chinese shale rocks are also packed with clay and is much wetter than American shale, making it harder to crack the shale and release the gas through pumping liquids and sand underground, the process known as hydraulic fracturing, or fracking. China’s shale rocks are concentrated in Sichuan Province near Tibet in the far West of China. That is precisely where China’s greatest earthquake zone is concentrated.

As I detailed in my recent book, China in Gefahr, which in Chinese translation has become a leading bestseller and read by leading policy circles according to reports, the shale gas illusion was a geopolitical ploy by leading Washington circles to divert China’s energy pursuits from the Middle East and Africa and lead them down a dead end.

In 2011, the United States Energy Information Administration of the government estimated that China had “technically recoverable” reserves of 1.3 quadrillion cubic feet, nearly 50 percent more than the United States. That report, done by a private Washington consulting company that was in many cases based apparently on pure conjecture, created a major illusion in China that shale gas was their magic wand to energy security.

Even more dangerous for China, shale gas fracking techniques have been proven to induce earthquakes and to use staggering volumes of water. The last thing China needs is more earthquakes in the growing industrial center of Sechuan which also has significant water problems.

Now, with the realization that US oil companies and the US Department of Energy misled China, the door is open to explore realistic alternatives less destructive to the country.

Shale energy being rejected

Not just China is experiencing a reassessment of the riches of shale gas and oil. In country after country, the dreams of shale are being abandoned or downsized as in China. France and Bulgaria have banned the development of shale sources in response to local fears that fracking could cause earthquakes.

In Russia, industry reports are that giant energy firms such as Lukoil, who have tested shale gas extraction have concluded it is a dead end. The rate of depletion of shale formations is dramatically faster than for conventional gas and Russia holds the world’s largest reserves of conventional gas.

F. William Engdahl, strategic risk consultant and lecturer, holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

Editing: Jim W. Dean and Erica P. Wissinger

Frederick William Engdahl (born August 9, 1944) is an American writer, economics researcher, historian, and freelance journalist.

He is the author of the best-selling book on oil and geopolitics, A Century of War: Anglo-American Oil Politics and the New World Order. It has been published as well in French, German, Chinese, Russian, Czech, Korean, Turkish, Croatian, Slovenian, and Arabic. In 2010 he published Gods of Money: Wall Street and the Death of the American Century, completing his trilogy on the power of oil, food, and money control.

Mr. Engdahl is one of the more widely discussed analysts of current political and economic developments, and his provocative articles and analyses have appeared in numerous newspapers and magazines and well-known international websites. In addition to discussing oil geopolitics and energy issues, he has written on issues of agriculture, GATT, WTO, IMF, energy, politics, and economics for more than 30 years, beginning the first oil shock and world grain crisis in the early 1970s. His book, ‘Seeds of Destruction: The Hidden Agenda of Genetic Manipulation has been translated into eight languages. A new book, Full Spectrum Dominance: Totalitarian Democracy in the New World Order describes the American military power projection in terms of geopolitical strategy. He won a ‘Project Censored Award’ for Top Censored Stories for 2007-08.

Mr. Engdahl has lectured in economics at the Rhein-Main University in Germany and is a Visiting Professor in Economics at Beijing University of Chemical Technology.

After a degree in politics from Princeton University (USA), and graduate study in comparative economics at the University of Stockholm, he worked as an independent economist and research journalist in New York and later in Europe, covering subjects including the politics of energy policy in the USA and worldwide; GATT Uruguay Round trade talks, EU food policies, the grain trade monopoly, IMF policy, Third World debt issues, hedge funds, and the Asia crisis.

Engdahl contributes regularly to a number of international publications on economics and political affairs including Asia Times, FinancialSense.com, 321.gold.com, The Real News, Russia Today TV, Asia Inc., GlobalResearch.com, Japan’s Nihon Keizai Shimbun, Foresight magazine. He has been a frequent contributor to the New York Grant’sInvestor.com, European Banker and Business Banker International and Freitag and ZeitFragen in Germany, Globus in Croatia. He has been interviewed on various geopolitical topics on numerous international TV and radio programs including Al Jazeera, CCTV and Sina.com (China), CCTV (China) Korea Broadcasting System (KBS), and RT Russian TV. He is a Research Associate of Michel Chossudovsky’s well-respected Centre for Research on Globalization in Montreal, Canada, and a member of the editorial board of Eurasia magazine.

Mr. Engdahl has been a featured speaker at numerous international conferences on geopolitical, GMO, economic, and energy subjects. Among them is the Ministry of Science and Technology Conference on Alternative Energy, Beijing; London Centre for Energy Policy Studies of Hon. Sheikh Zaki Yamani; Turkish-Eurasian Business Council of Istanbul, Global Investors’ Forum (GIF) Montreaux Switzerland; Bank Negara Indonesia; the Russian Institute of Strategic Studies; the Chinese Ministry of Science and Technology (MOST), Croatian Chamber of Commerce and Economics.

He currently lives in Germany and, in addition to teaching and writing regularly on issues of international political economy and geopolitics, food security, economics, energy, and international affairs, is active as a consulting political risk economist for major European banks and private investors. A sample of his writings is available at Oil Geopolitics.net

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy