… by F. William Engdahl, … with New Eastern Outlook, Moscow

___

[ Editor’s note: We began writing on the death of the shale gas and oil hype early last year. But we do not claim to be the original experts, as VT has a deep bench, and brother Engdahl was all over this pump and dump scam from its inception.

We know a good thing when we find it, so we promoted his work heavily, including recommending him to New Eastern Outlook, our partner publication in Moscow, where he has become a top contributor.

Engdahl explained all the shale energy fundamentals to us, and the economics were clearly another rich man’s manipulation scam. What surprised us was when the West started the Ukrainian crisis and rolled out its pre-fabricated media campaign.

They campaigned that the EU needed alternate sources of gas so as not be held prisoner by the Russian gas market. It seemed too well prepared to be conveniently shoe-horned into the Ukrainian energy crisis. We smelled the usual psyops stage managing.

Congress once again showed how low it could go, with the talking airheads crowing about how US gas exports could replace Russian gas. This would be an export bonanza for US export earnings, and then we could hold Europe as an energy hostage.

Gordon Duff blew that silliness out of the water when his research showed that all of our known shale gas production had already been pre sold to Asian customers. Not only did new shale gas supplies have to be found, but the infrastructure built both here and in Europe, would be a ten-year project just for openers.

On the European side, horribly expensive LNG port facilities would have to be constructed (if room for them could be found anywhere), plus a new gas distribution system from the Atlantic.

Critics in the EU were quick to come up with a rough estimate of $100 billion to do that. No one had any idea where the money would come from. And when added to the huge cost for this expensive American LNG gas, the EU customers would have an energy cost disaster on their hands, and an estimated 50% increase in their bills.

This is how stupid some of these Congressmen are. It’s almost beyond description, and this is just one issue. The ones really capable of understanding complex issues or even seeing through an age old scam are few and far between. Most are handed their talking points and pull their puppet socks over their heads.

They are held in contempt by the loyal factions in the security community, including much of the leadership, like John McCain. A large number of them have always been viewed as national security risks, not only because of their work for Israeli Intelligence, but because of their potential work for anyone else with a pocket of cash… Jim W. Dean ]

_________________________________

– First published … January 27, 2014 –

When I was a young child growing up in America, a popular silly children’s rhyme was called Pop! goes the Weasel. One verse went: “A penny for a spool of thread, A penny for a needle —That’s the way the money goes, Pop! goes the weasel.”

The “weasel” known as the USA fracking revolution, America’s recent shale gas and shale oil boom, which has been touted by the Obama Administration as grounds for risking their radical regime change policies across the OPEC Islamic world, is going “pop!,” as the money goes…

The collapse of the five-year-old USA fracking revolution is proceeding with accelerating speed as jobs are being slashed by the tens of thousands across the United States; shale oil companies are declaring bankruptcy and Wall Street banks are freezing new credits to the industry.

The shale weasel in America has just gone pop!, and soon the bloodbath will look like the aftermath of the Battle of Falkirk of Braveheart fame.

Unintended consequences

One of the unfortunate consequences of being in political blinders, as the leading figures around President Barack Obama today definitely are, is that their bold policy decisions tend to blow up in their faces with unintended consequences.

So it is with poor, pathetic Secretary of State John Kerry. Last September Kerry went to Saudi Arabia to the King’s summer palace on the Red Sea, to meet with the King of OPEC’s largest oil producer, Abdullah, and his advisers including by informed reports, Prince Bandar “Bush”, the former Washington Ambassador and former head of Saudi Intelligence responsible for the disastrous war against Assad in Syria.

There, a deal was agreed, whereby the Saudis would flood the market, especially in Asia, with deeply discounted crude oil to force a price collapse. For Kerry and the Obama gang of myopics, it was a clever way to kill two birds—Iran and Russia—with one Saudi cheap oil stone.

Far from “killing” Putin’s Russia, it has dramatically accelerated a major consolidation of Russia-China energy cooperation in huge deals that shift the Russian energy market from west and the EU to the east—China, the two Koreas and Japan.

Putin also boldly cancelled the EU South Stream gas project and opened negotiations with Turkey to make that key nation into a world “energy hub” instead, cutting the US-controlled Ukraine entirely out of the game of being transit to Russian EU gas traffic.

Far from killing Iran, it has accelerated major Iran energy deals with Russia including new nuclear power plants. And, despite all the best intentions of the CIA and Israeli intelligence services, who invested so much time and energy creating the psychopaths known as ISIS or as they now call it, IS, Bashar al Assad, backed by Russia and Iran, still is in Damascus. For Washington and its pathetic neo-cons, nothing seems to work anymore like they want.

What the not-so-well-thought-through Washington oil shock game has done, however, is to trigger an avalanche of bankruptcies and job cuts in the domestic US oil and gas industry, above all, the shale energy sector.

_______________________________

The USA shale oil catastrophe

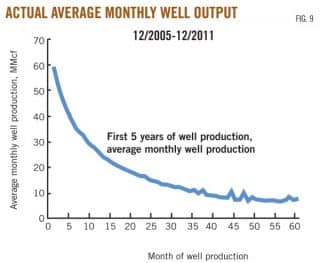

The collapse of the domestic USA shale industry, which I predicted last year to become manifest sometime in the first quarter of 2015, is already visible.

And this is just the beginning of what will be a snowballing of unpayable debts, shut-in oil wells, massive layoffs in the US oil and gas industry in the next several months.

According to OilPrice.com, spending on global oil and gas exploration and production could fall over 30 percent this year. That would be the greatest drop since 1986, the last time Washington tried to use the Saudis to collapse oil prices.

Bank of America predicts Brent oil futures to fall to $31 by the end of the first quarter this year, over $5 below the lows of the 2008 financial crisis.

Right now the oil market is in a perverse situation where, not surprisingly, major producers like Russia and Iran and Iraq, predictably, are increasing production to offset falling prices and state revenues. That makes the existing glut even more dramatic.

The results in the USA are just emerging. A huge round of job cuts is sweeping the industry, especially in the USA. On January 13, the Dallas Fed projected that in Texas alone, 140,000 jobs could be eliminated.

That, in only one state, albeit the largest oil state in the USA. Those are well-paid jobs in an economy which is already suffering huge job losses (despite fraudulent US Government labor statistics) since the 2008 financial crisis hit.

Schlumberger, the world’s biggest oilfield-services company, will cut 9,000 jobs, after its Fourth Quarter 2014 net income plunged 81% following €1.6 billion in write-offs that included its production assets in Texas. The second largest oil services giant, Halliburton, Dick Cheney’s old firm, and the company that made the shale bubble doable technically, has announced layoffs but declines to say how many.

Oil-field services companies like Halliburton, suppliers of the fracking chemicals and drilling equipment, steel companies, housing accommodation providers all benefited. No more.

The US shale oil boom was a Wall Street bubble, as we noted before, fuelled by the Federal Reserve zero interest rates and Wall Street banks desperate for places to lend after the real estate bubble collapsed in 2008. They made nice fat profits by underwriting so-called junk bonds for the shale oil companies, many of them small-to-medium size companies that will go under now.

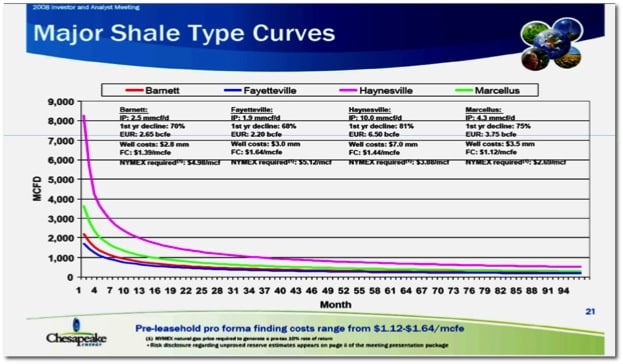

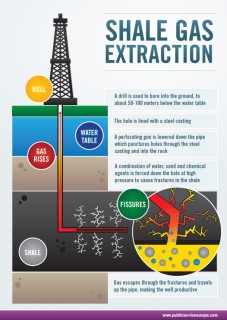

Shale drilling and fracking is a costly business, far more than conventional oil drilling. That’s why it is called “unconventional.”

As long as US interest rates were at bottom the last six years and oil prices well above $100 a barrel, oil companies could take the risk and banks could lend with abandon. That’s come to a screeching halt as oil revenues have plunged 40-50% in the past seven months.

As long as prices were high, the shale oil companies could borrow like there was no tomorrow. And they did. According to a new estimate by Barclays Bank of UK, the USA and Canadian oil industry is likely to slash at least $58 billion from spending, a 30% cut from 2014 spending of $196 billion.

That estimate was prepared from company data taken in December when the price was $74 a barrel, before the cuts began to hit and before prices plunged to $47 a barrel. The final number on spending will be far lower by year end, if prices remain low. The longer prices stay below $50 a barrel the bloodbath will grow. They estimate that the US oil industry will be hardest hit of all the world. Nice job, John Kerry and Co.

And new bank lending has also screeched to a halt. Oops…In the boom times until September 2014 when the Saudi price war began, US and Canadian small to midsized companies spent more than their cash income by an eye-popping average 157 percent. Larger firms overspent by around 112 percent. They made up the difference by issuing junk bonds and taking low-interest bank loans.

Now, with prospects very bleak for price recovery, the lending banks are turning off the money spigot. The losses will soon hit Wall Street as well.

The unintended consequences of the stupid Kerry strategy to bankrupt Putin’s Russia with aid of the Saudis has blown up in his face and may soon bury the over-hyped US shale oil bubble in a sea of red ink and bankruptcy filings. Stupid in this sense is in not comprehending the connections of everything in the real world.

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

Jim W. Dean was an active editor on VT from 2010-2022. He was involved in operations, development, and writing, plus an active schedule of TV and radio interviews.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy