… by Oleg Reschikov, … with New Eastern Outlook, Moscow

[ Editor’s Note: Oleg Reschikov brings us a reminder of the banking sanctions on Iran when most of our attention has been focused on the Russian ones for many months now.

It brought back memories for me of when VT first started covering some of the workarounds, like the Turkish gold connection reviewed below.

When Iran was the only major target in the sanction crosshairs, most other nations did not really think too much about, “what if that were me in the crosshairs.”

The nuclear weapons program tie in was reasonably excluded for most concerns. But now we know the nuke scare was just a hoax to conduct economic warfare on Iran.

And this was being done – mind you – when the Sandia Labs’ 9-11 Nuclear Attack Report had been on file since 2003, and special US recovery teams had been hunting the missing nukes pilfered from our old bomb storage and reprocessing facilities, where the inventory books were cooked to hide it.

So while the American people were kept in the dark about a nuclear 9-11 — one that included official Israeli participation — we are all taken on a wild goose diversion chase to Iran, and another war was averted only because a false flag to trigger it was stopped a couple of times.

While we were chasing the bogeyman bogus nuke scam during the Bush hoodlum regime, we were covered up in nuclear threats back here at home, with treasonous insiders – American citizens – working with the one country that is a threat to everybody… Israel.

It is now being peddled that the two independent SE Ukraine Republics are the tip of the spear for Russia’s plans to retake the old Soviet Empire. The contempt our leaders have for us is off the charts, but we are yet to return the favor. How long will we stay on our knees, might I ask you, dear readers? … Jim W. Dean ]

________________________

– First published … January 01, 2015 –

The Islamic Republic of Iran has for many years suffered from significant multifaceted pressure from the West.

Persistence and resourcefulness has allowed Iranian businesses and Iran as a whole to skillfully overcome the barriers erected by US and European sanctions.

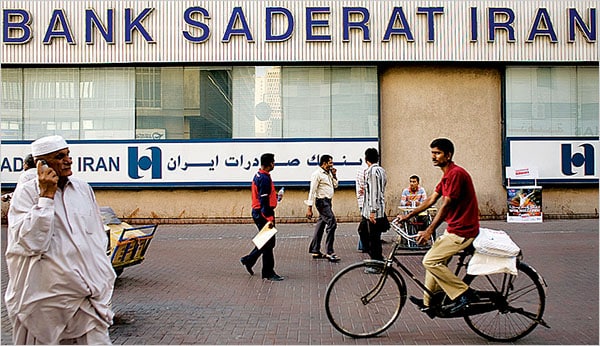

With the resumption of Iran’s nuclear program in 2005, the ring of sanctions against Iranian banking institutions was tightened.

The United States regularly updates its extraterritorial sanctions against Iran and the list of Iranian banks with which American and foreign companies and banks are prohibited from engaging in any activity.

The European Union, following the United States, revealed its sanctions list of Iranian banks and a list of restrictions on the conduct of financial activities with Iran. The “double attack” of the European Union in 2012 had a strong effect: the embargo on Iranian oil and the exclusion of Iran from the international interbank information transmission system SWIFT.

As a result, in 2014 the vast majority of Iranian public and private banks were cut off from the European and American banking systems and had minimal capabilities to purchase US dollars and euros for foreign trade transactions.

In these seemingly catastrophic conditions, Iran began to actively use alternative ways of implementing international interbank payments on international contracts.

Emphasis was placed on payments to trading partners in national currencies and conduct of barter transactions.

The main commodities for which Iran has received funds or goods are hydrocarbons. Thus, Turkey, India, and China have agreed on settlements in the lira, rupee, and yuan respectively.

Using accounts in the national banks of these countries, Iran could buy locally produced goods. Moreover, Iran, being in a situation of banking isolation, began to develop trade with the use of gold as a means of payment.

For example, Turkey entered into transactions with Iran on a “gas in exchange for gold” basis, in connection with which Ankara has received serious political pressure from the European Union and the United States, which eventually imposed a ban on the sale of gold and other precious metals to Iran.

It should be noted that in the bypass of Western sanctions calculated in local currencies, barter and gold do not represent the whole range of effective tools.

To meet their needs for international transactions, Iranian individuals and entities also used, at the very least, the banking services of third countries, money transfer systems, and currency exchange in third countries. In addition, Iran appealed to the governments of several countries with the idea of creating joint banks.

Various sources note that Iranian entrepreneurs make money transfers via “hawala”.

This is a system distinguished by the fact that it lacks an extensive bureaucracy, the transactions are mainly conducted in amounts under 100 thousand USD, and the transfer reaches its destination within 48 or even 24 hours.

In general, these features allow the majority of the system’s brokers to evade the attention of US regulators who watch over the maintenance of the sanctions regime against Iran and the fight against money laundering. The benefits of “hawala” also include the low commission for transactions: about 1 – 1.5%.

For example, some financial transactions between Iran and Pakistan are conducted through the system rather than using the legal channels of the Asian Clearing Union.

The experts recognized that “hawala” can provide money transfer from Iran to a country in the Middle East, and then a transaction to various banks in Asia, Europe, and the United States.

In addition, Iranian economic actors use the services of third-country banks. The sole feature of this type of transaction for banks and companies subject to western sanctions is the high commission for conducting transactions. In particular, banks in the Middle East and the Transcaucasia were involved in the chains of banking transactions.

Another interesting story is that of Iran’s interaction with European banks in the period after 2008, when Washington imposed sanctions on the extraterritorial exercise of all Iranian bank transactions under the “U-turn” scheme and since then classified the involvement of banks in third countries in such transactions in Iran’s interest as money laundering.

In general the “U-turn” scheme was as follows: Iran supplied oil to a customer, the transaction was paid in the currency of the buyer, the money was transferred to the account of a bank not registered in Iran, then the funds were transferred to an account in a US bank, after which it was converted into US dollars, then the amount already in USD was transferred to another foreign bank account from which the money returned to Iran.

As a result, Iran received the payment for delivered oil not in the national currency of the buyer, but in US dollars.

In December 2012, information was published that the British bank “Standard Chartered”, using “U-turn” transactions, was able to conduct more than 60 thousand transactions in the interest of Iranian financial institutions, for which US authorities accused the bank of money laundering in the interest of Iran.

As a result, “Standard Chartered” paid the American treasury 327 million dollars as a penalty.

Other institutions involved in investigations into cases of violation of the sanctions regime against Iran also include “Royal Bank of Scotland”, “UniCredit”, “HSBC”, “Deutsche Boerse”, “Société Générale”, and “Crédit Agricole”.

Overall, despite the introduction of sanctions by Washington, many reputed European banks continued transactions with Iranian customers.

Another way for Tehran to obtain foreign currency funds in dollar terms was the simple cash exchange of the Iranian rial for the US dollar in other countries. For example, in September 2012 in Herat, Afghanistan, an increased activity was detected on the exchange of the Iranian rial for the US dollar.

It was reported that the Iranian moneychangers, through their Afghan mediators, exchanged their desired amount and quickly moved the funds to the territory of Iran. Iranian taxis shuttling between the Iranian-Afghan border and Herat could be used as a means of moving the money.

Thus, the experience of Tehran in bypassing the barriers in the banking sector can be called a worthy part of the “economy of resistance”, and this experience may be useful for other countries in their struggle with the effect of Western sanctions.

Iran’s actions confirm, firstly, that the West cannot provide comprehensive control over the maintenance of its imposed sanctions regime and, secondly, that there is an “antidote” to the sanctions: in the face of counter-sanction activities, the public and private sector can find and effectively use workarounds for the sanctions.

For this reason, under the conditions of sanctions for the functioning of the banking system for the development of foreign trade, it is possible to carry out a comprehensive policy for the maintenance and development of economic relations with key trading partners.

This activity involves the use of an extensive toolkit which includes a re-orientation of the national banking system to other parts of the world, conduct of payments in national currencies, barter transactions, the use of gold as a means of payment, and other methods.

Oleg Reschikov, MA of the Moscow State Institute of International Relations (MGIMO) of the Russia’s Ministry of Foreign Affairs, especially for online magazine “New Eastern Outlook”.

Jim W. Dean was an active editor on VT from 2010-2022. He was involved in operations, development, and writing, plus an active schedule of TV and radio interviews.

ATTENTION READERS

We See The World From All Sides and Want YOU To Be Fully InformedIn fact, intentional disinformation is a disgraceful scourge in media today. So to assuage any possible errant incorrect information posted herein, we strongly encourage you to seek corroboration from other non-VT sources before forming an educated opinion.

About VT - Policies & Disclosures - Comment Policy